As we learnt during Release 12, the E-Business Suite has couple of new products like Subledger Accounting, E-Business Tax thus significant changes have been observed in Account Payable data module as some of functionality is shared by some other products. Thus it is important to understand what is new. I would like to briefly outline the details of some of new changes and underlying impact on the objects. More details can be found in R12 release documents published by Oracle a month ago.

Let’s have a dissection view of R12 payable, with some of its core objects Supplier

Supplier

We have seen in 11i

- Suppliers defined in AP.

- Supplier contacts replicated for each supplier site.

Where as in R12

- Supplier becomes as TCA Party.

- Suppliers Sites as TCA Party Site for each distinct address.

- Contacts for each supplier/address , it means Single supplier address and contact can be leveraged by multiple sites, for each OU

- A single change to an address can be seen instantly by all OUs

- No longer need to manually 'push' updates across OUs.This can be best understood by the figure below.

Then the question is what will happen if any one can come from existing financial products. The Impact from upgrade can summarize as:

1. When we upgrade supplier tables replaced with backward compatible views.

2. One party site for each distinct supplier site address

Country and address line1 are required, this is because creation of suppliers in Party in TCA data model would requires Country and address information, but it also understood if there is no country or address line 1 specified for a supplier site in cases when upgrades takes place, Payables derives the country based on the most frequently used operating unit of the Supplier's historical transactions.

3. Employee as suppliers: address NOT migrated to party site in TCA remains in Oracle HR for data security reasons.

As we know in 11i employees are part of internal supplier's record in order for Oracle Payables to create payments for their expense reports. Employees defined in Oracle Human Resources and associated with an Oracle Payables supplier record have existing party information. During the upgrade, Oracle Payables updates the existing party information to have a party usage of supplier but it does not migrate the employee address to the party site in TCA, they remain in Oracle Human Resources for data security reasons.

4. Utilize TCA Party relationships for franchise or subsidiary and its parent company. Invoice

Invoice

Till 11i version, we have seen invoices:

- Had only distributions line.

- Allocation of freight and special charges are captured at the distribution level only

- Tax and payment and Project accounting Payment was captured through global Descriptive Flexfields.

But in R12,

1. Invoice Lines as a new additional line accommodated in Invoice data model.

Because of introduction of invoice line there is significant improvement of data flow with n other oracle modules like

- Fixed Asset - Asset Tracking

- Business Tax - Tax line

- Payment - Payment

- SubLedger Accounting - Accounting

2. Allocate freight and special charges are captured to the lines on the invoice

3. Invoice distributions created at the maximum level of detail similar to 11i.

4. Core functionality

3. Invoice distributions created at the maximum level of detail similar to 11i.

4. Core functionality

The impact with Upgrade can be summarized as:

1. One invoice line for every distribution in 11i

2. Sub Ledger Accounting requires that Payables transform the invoice distributions to be stored at the maximum level of detail

3. Global Descriptive Flexfields migrated to named columns.

2. Sub Ledger Accounting requires that Payables transform the invoice distributions to be stored at the maximum level of detail

3. Global Descriptive Flexfields migrated to named columns.

That's means functional testing is more required while upgrade takes place. Banks and Bank Details

Banks and Bank Details

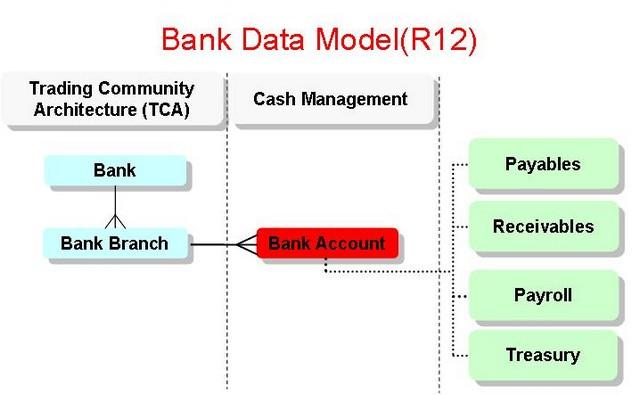

Now a days corporate treasury role has been greatly enhanced thus picking up a global bank as partner for all banking need is demand of time in global working model. The recent couple of years have seen drastic increase in acquisition and merger of company thus global working as well as global instance get popularity in ERP areana, and this is one of reason of the reason bank data model has been significant changes from 11 to 11i and 11i to R12.

Internal Bank Accounts

In 11i we have seen internal Banks defined in AP and that is shared by AP/AR/CE, Payroll and Treasury and they are bank accounts often replicated in multiple OUs

In 11i we have seen internal Banks defined in AP and that is shared by AP/AR/CE, Payroll and Treasury and they are bank accounts often replicated in multiple OUs

Where as in R12,

- Bank and Branch become part of TCA Parties.

- Internal Bank Account in Cash Management which is owned by a Legal Entity. Here the Operating units have granted usage rights.

Suppliers Bank Accounts

In 11i

In 11i

- Banks/Branches defined in AP

- Bank accounts often replicated in multiple OUs Before

R12

- Suppliers, Banks and Branches are defined as Parties in TCA

- Supplier (party's) payment information and all payment instruments (Bank Accounts, Credit Cards) moved into Oracle Payments.

The typical data model for bank can be summarized as:

Impact of Upgrade

1. With Upgrade banks and branches migrated to TCA parties

2. Banks merged if the following attributes are all the same:

2. Banks merged if the following attributes are all the same:

- a. Bank Number

b. Institution type

c. Country

d. Bank admin email

e. Bank name alt

f. Tax payer ID

g. Tax reference number

h. Description, Effective dates

3. Bank accounts, bank account uses are migrated into cash management.

4. Transactions are stamped with the bank account uses identifiers as part of the upgrade Integration with Oracle E-Business Tax

Integration with Oracle E-Business Tax

4. Transactions are stamped with the bank account uses identifiers as part of the upgrade

In 11i

- Oracle standard functionality was based out of User which determines tax by assigning Tax Codes at line level of invoice and Tax rules was controlled at underline code.

- There was global descriptive flex fields were captured for country-specific tax attrib

utes.

- More importanta most of the setup performed at OU level.

In R12

- A new module eBusinessTax determines tax based on facts about each transaction, this is reason why Oracle has introduced additional line information at invoice level.

- The module "ebusiness Tax" set and configure Tax rules which can be viewed

- Tax attributes collected in fields on key entities

- Configure tax rules once per regime and share with your legal entities

Impact of Upgrade

1. Payables Tax setup, Tax Code defaulting rules defined per OU are migrated to eBusiness Tax.

2. OUs migrated to tax content owner in R12

3. Tax information in tax codes are transformed to Regime-Rate flow.

4. E-Business Tax takes information from the AP invoice lines and creates summary and detail tax lines in the E-Business Tax repository. Multi Org Access Control

Multi Org Access Control

1. Payables Tax setup, Tax Code defaulting rules defined per OU are migrated to eBusiness Tax.

2. OUs migrated to tax content owner in R12

3. Tax information in tax codes are transformed to Regime-Rate flow.

4. E-Business Tax takes information from the AP invoice lines and creates summary and detail tax lines in the E-Business Tax repository.

MOAC is new enhancement to the Multiple Organizations feature of Oracle Applications.

This feature enables user to access data from one or many Operating Units while within a set given responsibility. Due to this change, all processing and some Reporting in Oracle Payables is available across Operating Units from a single Applications responsibility. Hence you can isolate your transaction data by Operating unit for security and local level compliance while still enabling shared Service centre processing.Data security is maintained using the Multiple Organizations Security Profile, defined in Oracle HRMS, which specifies a list of operating units and determines the data access privileges for a user.

Impact of Upgrade

R12 Upgrade does not automatically create security profiles, thus is important if any one want to use Multiple Organizations Access Control, the first things is to define security profiles, then link them to respective responsibilities or users.

R12 Upgrade does not automatically create security profiles, thus is important if any one want to use Multiple Organizations Access Control, the first things is to define security profiles, then link them to respective responsibilities or users.

No comments :

Post a Comment